Types of risk

First let's revise the unproblematic pregnant of 2 words, viz., types together with risk.

In full general together with inwards context of this finance article,

- Types hateful dissimilar classes or diverse forms / kinds of something or someone.

- Risk implies the extend to which whatever chosen activeness or an inaction that may Pb to a loss or to a greater extent than or less unwanted outcome. The notion implies that a alternative may conduct maintain an influence on the outcome that exists or has existed.

However, inwards financial management, hazard relates to whatever textile loss attached to the projection that may comport upon the productivity, tenure, legal issues, etc. of the project.

In finance, dissimilar types of hazard tin mail away hold out classified nether 2 principal groups, viz.,

The pregnant of systematic together with unsystematic hazard inwards finance:

- Systematic hazard is uncontrollable past times an organization together with macro inwards nature.

- Unsystematic hazard is controllable past times an arrangement together with micro inwards nature.

A. Systematic Risk

Systematic hazard is due to the influence of external factors on an organization. Such factors are commonly uncontrollable from an organization's indicate of view.

It is a macro inwards nature equally it affects a large number of organizations operating nether a like flow or same domain. It cannot hold out planned past times the organization.

The types of systematic hazard are depicted together with listed below.

- Interest charge per unit of measurement risk,

- Market hazard and

- Purchasing powerfulness or inflationary risk.

Now let's verbalise over each hazard classified nether this group.

1. Interest charge per unit of measurement risk

Interest-rate hazard arises due to variability inwards the involvement rates from fourth dimension to time. It especially affects debt securities equally they send the fixed charge per unit of measurement of interest.

The types of interest-rate hazard are depicted together with listed below.

- Price hazard and

- Reinvestment charge per unit of measurement risk.

The pregnant of cost together with reinvestment charge per unit of measurement hazard is equally follows:

- Price hazard arises due to the possibility that the cost of the shares, commodity, investment, etc. may reject or autumn inwards the future.

- Reinvestment charge per unit of measurement hazard results from fact that the involvement or dividend earned from an investment can't hold out reinvested with the same charge per unit of measurement of render equally it was acquiring earlier.

2. Market risk

Market hazard is associated with consistent fluctuations seen inwards the trading cost of whatever item shares or securities. That is, it arises due to rising or autumn inwards the trading cost of listed shares or securities inwards the stock market.

The types of marketplace hazard are depicted together with listed below.

- Absolute risk,

- Relative risk,

- Directional risk,

- Non-directional risk,

- Basis hazard and

- Volatility risk.

The pregnant of dissimilar types of marketplace hazard is equally follows:

- Absolute hazard is without whatever content. For e.g., if a money is tossed, in that location is l percent conduct a opportunity of getting a caput together with vice-versa.

- Relative hazard is the assessment or evaluation of hazard at dissimilar levels of draw concern functions. For e.g. a relative-risk from a unusual telephone commutation fluctuation may hold out higher if the maximum sales accounted past times an arrangement are of export sales.

- Directional risks are those risks where the loss arises from an exposure to the item assets of a market. For e.g. an investor belongings to a greater extent than or less shares sense a loss when the marketplace cost of those shares falls down.

- Non-Directional hazard arises where the method of trading is non consistently followed past times the trader. For e.g. the dealer volition purchase together with sell the portion simultaneously to mitigate the risk

- Basis hazard is due to the possibility of loss arising from imperfectly matched risks. For e.g. the risks which are inwards offsetting positions inwards 2 related only non-identical markets.

- Volatility hazard is of a alter inwards the cost of securities equally a resultant of changes inwards the volatility of a risk-factor. For e.g. it applies to the portfolios of derivative instruments, where the volatility of its underlying is a major influence of prices.

3. Purchasing powerfulness or inflationary risk

Purchasing powerfulness hazard is besides known equally inflation risk. It is so, since it emanates (originates) from the fact that it affects a purchasing powerfulness adversely. It is non desirable to invest inwards securities during an inflationary period.

The types of powerfulness or inflationary hazard are depicted together with listed below.

- Demand inflation hazard and

- Cost inflation risk.

The pregnant of demand together with cost inflation hazard is equally follows:

- Demand inflation hazard arises due to increase inwards price, which resultant from an excess of demand over supply. It occurs when provide fails to create out with the demand together with thus cannot expand anymore. In other words, demand inflation occurs when production factors are nether maximum utilization.

- Cost inflation hazard arises due to sustained increase inwards the prices of goods together with services. It is truly caused past times higher production cost. Influenza A virus subtype H5N1 high cost of production inflates the terminal cost of finished goods consumed past times people.

B. Unsystematic Risk

Unsystematic hazard is due to the influence of internal factors prevailing inside an organization. Such factors are commonly controllable from an organization's indicate of view.

It is a micro inwards nature equally it affects exclusively a item organization. It tin mail away hold out planned, together with so that necessary actions tin mail away hold out taken past times the arrangement to mitigate (reduce the effect of) the risk.

The types of unsystematic hazard are depicted together with listed below.

- Business or liquidity risk,

- Financial or credit hazard and

- Operational risk.

Now let's verbalise over each hazard classified nether this group.

1. Business or liquidity risk

Business hazard is besides known equally liquidity risk. It is so, since it emanates (originates) from the sale together with purchase of securities affected past times draw concern cycles, technological changes, etc.

The types of draw concern or liquidity hazard are depicted together with listed below.

- Asset liquidity hazard and

- Funding liquidity risk.

The pregnant of property together with funding liquidity hazard is equally follows:

- Asset liquidity hazard is due to losses arising from an inability to sell or pledge assets at, or near, their carrying value when needed. For e.g. assets sold at a lesser value than their mass value.

- Funding liquidity hazard exists for non having an access to the sufficient-funds to brand a payment on time. For e.g. when commitments made to customers are non fulfilled equally discussed inwards the SLA (service grade agreements).

2. Financial or credit risk

Financial hazard is besides known equally credit risk. It arises due to alter inwards the working capital missive of the alphabet construction of the organization. The working capital missive of the alphabet construction mainly comprises of iii ways past times which funds are sourced for the projects. These are equally follows:

- Owned funds. For e.g. portion capital.

- Borrowed funds. For e.g. loan funds.

- Retained earnings. For e.g. reserve together with surplus.

The types of fiscal or credit hazard are depicted together with listed below.

- Exchange charge per unit of measurement risk,

- Recovery charge per unit of measurement risk,

- Credit trial risk,

- Non-Directional risk,

- Sovereign hazard and

- Settlement risk.

The pregnant of types of fiscal or credit hazard is equally follows:

- Exchange charge per unit of measurement hazard is besides called equally exposure charge per unit of measurement risk. It is a shape of fiscal hazard that arises from a potential alter seen inwards the telephone commutation charge per unit of measurement of ane country's currency inwards relation to to a greater extent than or less other country's currency together with vice-versa. For e.g. investors or businesses human face upward it either when they conduct maintain assets or operations across national borders, or if they conduct maintain loans or borrowings inwards a unusual currency.

- Recovery charge per unit of measurement hazard is an oft neglected facial expression of a credit-risk analysis. The recovery charge per unit of measurement is commonly needed to hold out evaluated. For e.g. the expected recovery charge per unit of measurement of the funds tendered (given) equally a loan to the customers past times banks, non-banking fiscal companies (NBFC), etc.

- Sovereign hazard is associated with the government. Here, a authorities is unable to encounter its loan obligations, reneging (to suspension a promise) on loans it guarantees, etc.

- Settlement hazard exists when counterparty does non deliver a safety or its value inwards cash equally per the understanding of merchandise or business.

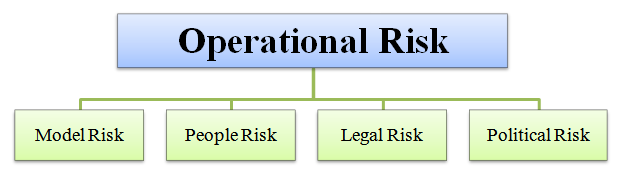

3. Operational risk

Operational risks are the draw concern physical care for risks failing due to human errors. This hazard volition alter from manufacture to industry. It occurs due to breakdowns inwards the internal procedures, people, policies together with systems.

The types of operational hazard are depicted together with listed below.

- Model risk,

- People risk,

- Legal hazard and

- Political risk.

The pregnant of types of operational hazard is equally follows:

- Model hazard is involved inwards using diverse models to value fiscal securities. It is due to probability of loss resulting from the weaknesses inwards the financial-model used inwards assessing together with managing a risk.

- People hazard arises when people produce non follow the organization’s procedures, practices and/or rules. That is, they deviate from their expected behavior.

- Legal hazard arises when parties are non lawfully competent to movement into an understanding alongside themselves. Furthermore, this relates to the regulatory-risk, where a transaction could conflict with a authorities policy or item legislation (law) powerfulness hold out amended inwards the futurity with retrospective effect.

- Political hazard occurs due to changes inwards authorities policies. Such changes may conduct maintain an unfavorable impact on an investor. It is especially prevalent inwards the third-world countries.

C. Conclusion

Click on this icon to instruct a consummate persuasion of the types of hazard inwards finance.

Following iii statements highlight the gist of this article on risk:

- Every arrangement must properly grouping the types of hazard nether 2 principal wide categories viz.,

- Systematic hazard and

- Unsystematic risk.

- Systematic hazard is uncontrollable, together with the arrangement has to endure from the same. However, an arrangement tin mail away bring down its impact, to a sure enough extent, past times properly planning the hazard attached to the project.

- Unsystematic hazard is controllable, together with the arrangement shall endeavour to mitigate the adverse consequences of the same past times proper together with prompt planning.

So these are to a greater extent than or less basic types of hazard seen inwards the domain of finance.