Introduction To Banks

Introduction To Banks

Banks cause got developed simply about 200 years ago. The natures of banks cause got changed equally the fourth dimension has changed. The term banking enterprise is related to fiscal transactions. It is a fiscal establishment which uses, coin deposited past times customers for investment, pays it out when required, makes loans at involvement exchanges currency etc. nevertheless to empathise the concept inwards particular nosotros postulate to encounter some of its definitions. Many economists cause got tried to hit dissimilar meanings of the term bank.

Nature of Commercial Banks

Nature of Commercial Banks

Commercial banks are an arrangement which ordinarily performs surely fiscal transactions. It performs the twin chore of accepting deposits from members of world too brand advances to needy too worthy people cast the society. When banks bring deposits its liabilities increment too it becomes a debtor, but when it makes advances its assets increases too it becomes a creditor. Banking transactions are socially too legally approved. It is responsible inwards maintaining the deposits of its concern human relationship holders.

Definitions of Commercial Banks

Definitions of Commercial Banks

While defining the term banks it is taken into concern human relationship that what type of chore is performed past times the banks. Some of the famous definitions are given below:

According to Prof. Sayers, "A banking enterprise is an establishment whose debts are widely accepted inwards village of other people's debts to each other." In this definition Sayers has emphasized the transactions from debts which are raised past times a fiscal institution.

According to the Indian Banking Company Act 1949, "A banking society agency whatever society which transacts the concern of banking . Banking agency accepting for the purpose of lending of investment of deposits of coin from the public, payable on demand or other wise too withdraw able past times cheque, draft or otherwise."

Functions of Commercial Banks

Functions of Commercial Banks

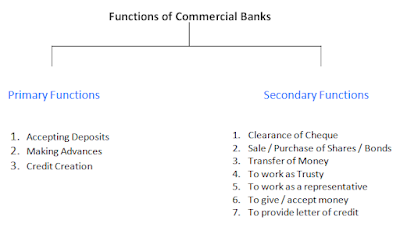

Commercial banking enterprise beingness the fiscal establishment performs various types of functions. It satisfies the fiscal needs of the sectors such equally agriculture, industry, trade, communication, etc. That agency they play real important role inwards a procedure of economical social needs. The functions performed past times banks are changing according to alter inwards fourth dimension too lately they are becoming client centric too widening their functions. Generally the functions of commercial banks are divided into 2 categories viz. primary functions too the secondary functions. The next nautical chart simplifies the functions of banks.

Primary Functions of Commercial Banks

Primary Functions of Commercial Banks

Commercial Banks performs various primary functions some of them are given below

- Accepting Deposits : Commercial banking enterprise accepts various types of deposits from world peculiarly from its clients. It includes saving concern human relationship deposits, recurring concern human relationship deposits, fixed deposits, etc. These deposits are payable afterward a surely fourth dimension period.

- Making Advances : The commercial banks furnish loans too advances of various forms. It includes an over draft facility, cash credit, pecker discounting, etc. They also hit demand too demand too term loans to all types of clients against proper security.

- Credit creation : It is nearly important component of the commercial banks. While sanctioning a loan to a customer, a banking enterprise does non furnish cash to the borrower Instead it opens a deposit concern human relationship from where the borrower tin withdraw. In other words spell sanctioning a loan a banking enterprise automatically creates deposits. This is known equally a credit creation from commercial bank.

Secondary Functions of Commercial Banks

Secondary Functions of Commercial Banks

Along amongst the primary functions each commercial banking enterprise has to perform several secondary functions too. It includes many agency functions or full general utility functions. The secondary functions of commercial banks tin last divided into agency functions too utility functions.

- Agency Functions : Various agency functions of commercial banks are

- To collect too clear cheque, dividends too involvement warrant.

- To brand payment of rent, insurance premium, etc.

- To bargain inwards unusual central transactions.

- To buy too sell securities.

- To human activity equally trusty, attorney, correspondent too executor.

- To bring revenue enhancement proceeds too revenue enhancement returns.

- General Utility Functions : The full general utility functions of the commercial banks include

- To furnish security locker facility to customers.

- To furnish coin transfer facility.

- To trial traveller's cheque.

- To human activity equally referees.

- To bring various bills for payment e.g telephone bills, gas bills, H2O bills, etc.

- To furnish merchant banking facility.

- To furnish various cards such equally credit cards, debit cards, Smart cards, etc.